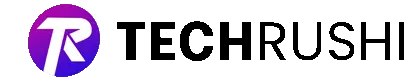

Apple Pay Later is Apple’s newest “Buy Now, Pay Later” feature. It lets you split any purchase from $50 to $1000 into four equal payments over six weeks, all without any interest or extra fees. You can use this payment method for online shopping or at local stores that accept Apple Pay.

In this guide, I’ll show you how to use Apple Pay Later and how to set it up on your iPhone.

How Apple Pay Later Works

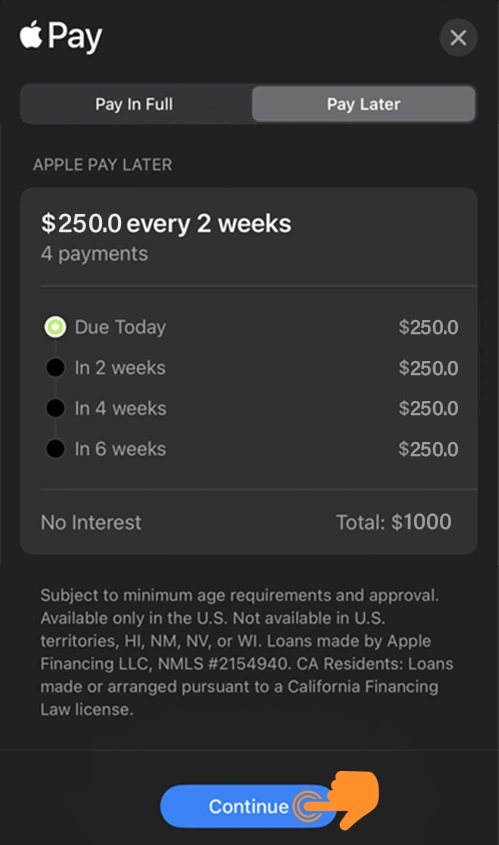

You can use Apple Pay Later on your iPhone through the Wallet app. When you buy something with Apple Pay Later, your six-week payment plan is divided into four equal parts. They’ll automatically charge your bill every two weeks from your linked bank. The best part is you don’t need to have money at the time of purchase.

Perks

- Ease of Use: Super convenient, especially if you’re a bit short on cash or want to spread out payments.

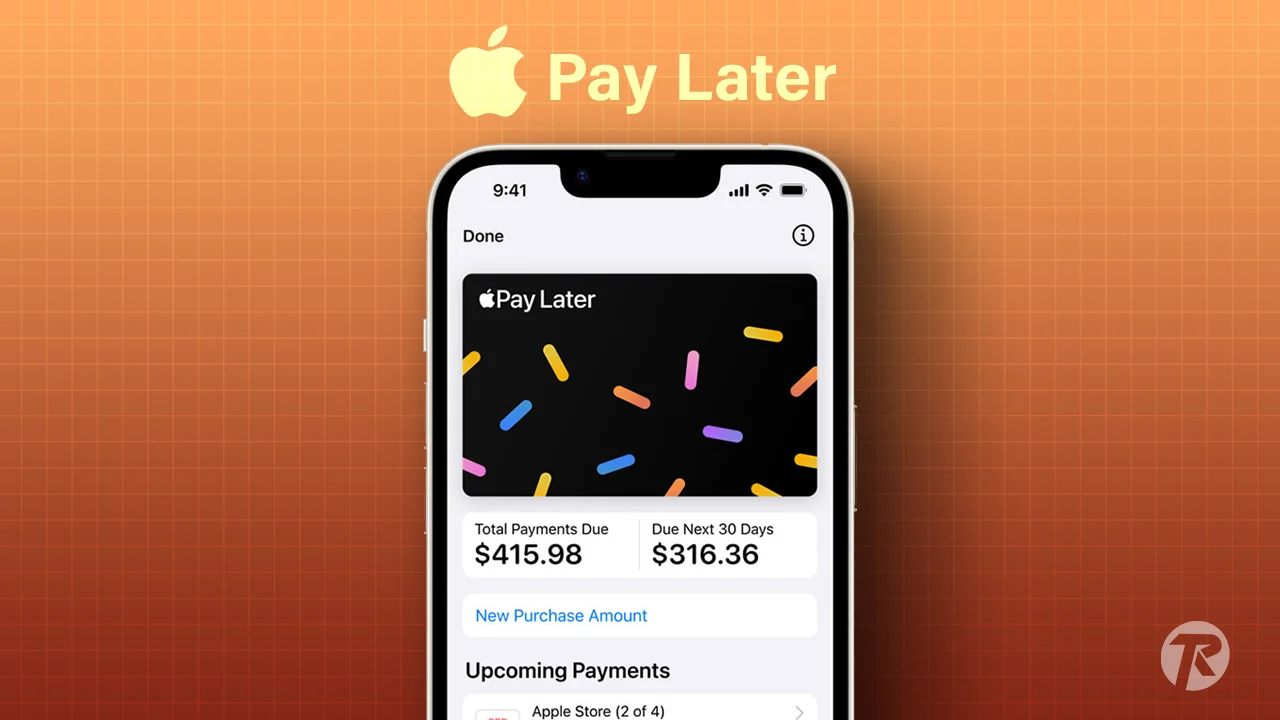

- Budget-Friendly: No extra costs like interest or fees.

- Versatile: Shop online or offline at local stores.

- Safe & Secure: It’s got all the top-notch security you expect from Apple Pay.

- Transparent: Keep track of your spending and payments straight from the Wallet app.

Basic Requirements

- Be at least 18 years old.

- A US address (no P.O. boxes, please).

- iOS 16.4 or newer on your device.

- Apple Pay is set up with an eligible debit card for the first payment.

- Two-factor authentication for your Apple ID.

- A Driver’s License or a state ID for identity verification.

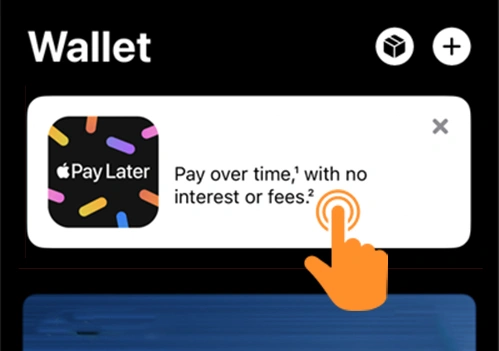

Note: Currently, Apple Pay Later is rolling out to a select group of users who get an invite. They’re picking people at random through Apple ID emails for this early version.

How to Set Up Apple Pay Later on iPhone

- Open the Wallet app on your iPhone.

- Hit the Add button (that’s the plus sign) or tap on “Set up Apple Pay Later.”

- Now, Tap on Apply Now to get started. Then hit the Continue button.

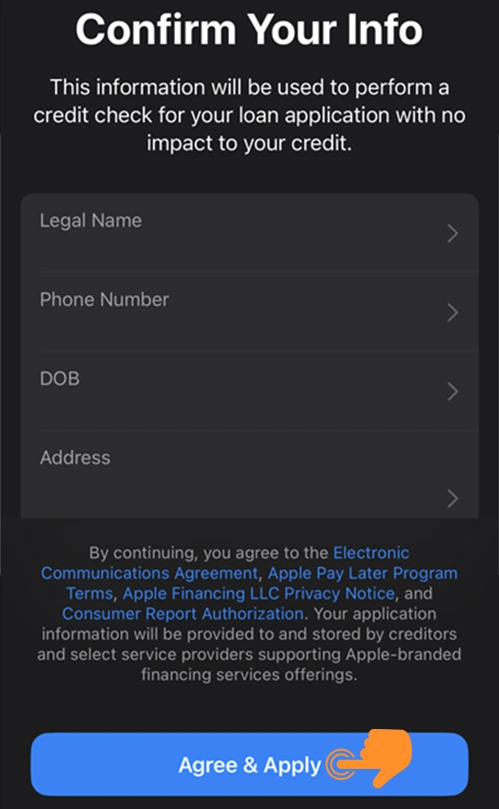

- Tap Next. Enter your name, phone number, birthday, and address. Confirm everything and hit “Agree & Apply.”

- Review everything and tap “Add to Wallet.”

Once your loan application is approved, a credit will be available for you to use. You’ll have a maximum of 30 days from the approval date to make a purchase. To view the approved amount, check the Available to Spend section of this feature.

How to Use Apple Pay Later on iPhone

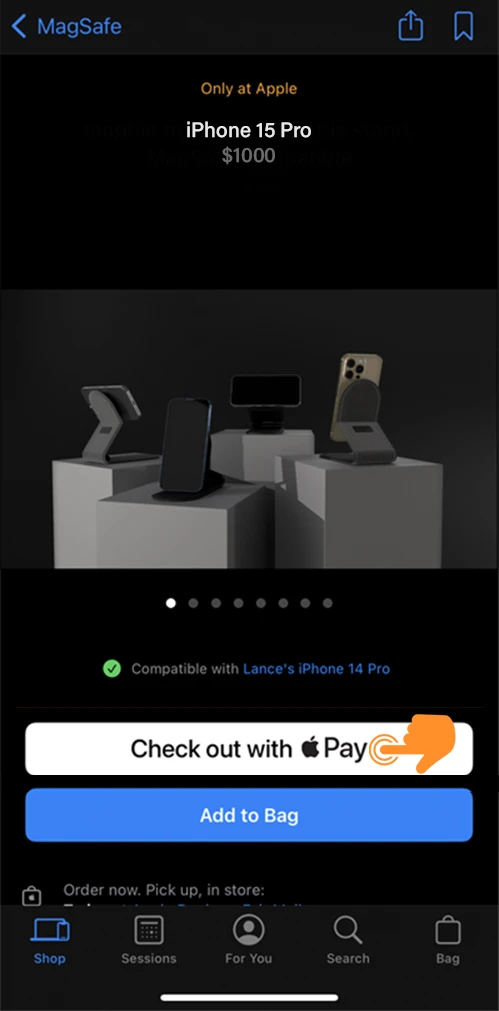

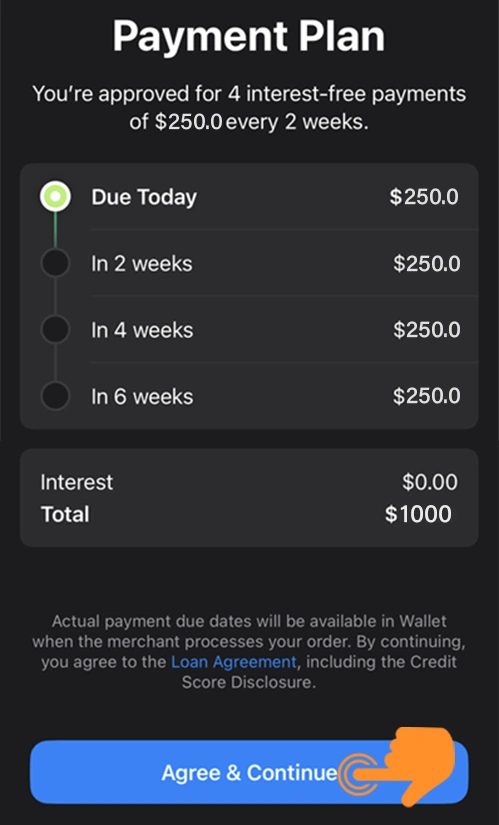

For instance, let’s say you own an iPhone 14 Pro and are considering upgrading to an iPhone 15 Pro. If the iPhone 15 Pro costs $1000, with Apple Pay Later, you can pay in 4 installments of $250 each.

Step 1: When checking out on a supported app or website, select Apple Pay for payment.

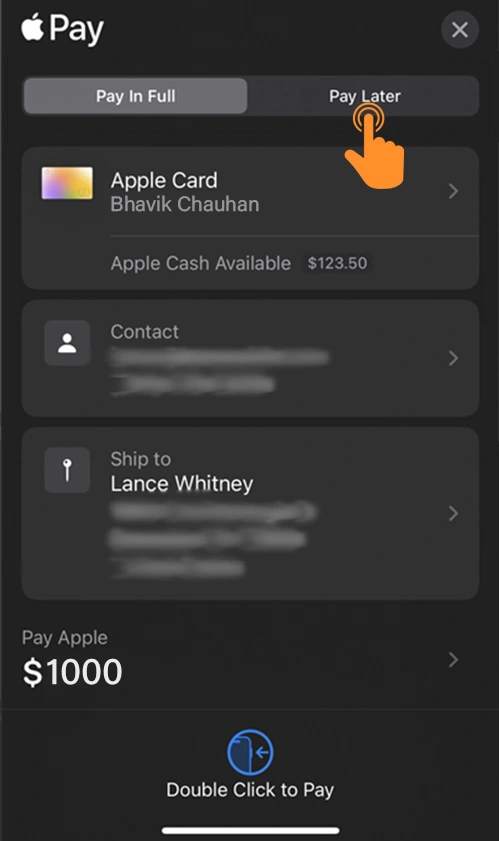

Step 2: Go to the Apple Pay tab and select the Pay Later option.

Step 3: Check your Apple Pay Later Payment Plan and Tap Continue.

Step 4: Review the payment details and agreement. Tap Continue or Agree & Continue.

Step 5: Choose the debit card for the initial payment and follow the prompts on-screen.

How to Remove Apple Pay Later

There are two ways to remove the Apple Pay Later Service:

- You can pay off your balance early. Once you have paid off your balance, your Apple Pay loan will be automatically closed.

- You can contact Apple Support and request that your Apple Pay Later loan be closed.

Note: Please note that if you close your Apple Pay loan, you will not be able to open another one for at least 6 months.

Additional benefits

- Improved credit score: Making your Apple Pay payments on time can help improve your credit score.

- Reduced debt: It can help you reduce debt by allowing you to spread the cost of purchases over time.

- Better financial management: It can help you better manage your finances by making it easier to budget and track your spending.

In a nutshell, Apple Pay Later is a game-changer for both shoppers and businesses alike. It’s user-friendly, budget-conscious, and secure. Whether you’re looking to spread out your payments for that next big purchase or trying to boost your store’s sales, this feature is worth exploring.

FAQs

Where is Apple Pay Later available?

It is available in the U.S. but not in Hawaii, Nevada, New Mexico, Wisconsin, or U.S. territories.

What are Apple Pay Later’s installment plan interest rates?

Apple Pay Later’s installment plans have no interest rates or fees, making them highly attractive.

What if I can’t make a payment on my Apple Pay Later loan?

Missing a payment prevents new purchases with Apple Pay Later, but you can still pay off existing loans. Once settled, you can reapply. Notably, even if overdue, there are no added fees or interest.